Scotland’s photonics sector continues to grow but access to investment must be a priority.

Technology Scotland has today published the results of its Photonics in Scotland 2024 survey.

This years’ survey is particularly important, following on from the recent launch of Scotland’s Critical Technologies Supercluster which has a stated ambition to grow beyond £10bn by 2035.

Data collected over the last 12 months reflects a sector that remains in good health, despite the challenging global landscape, which continued throughout 2023-2024.

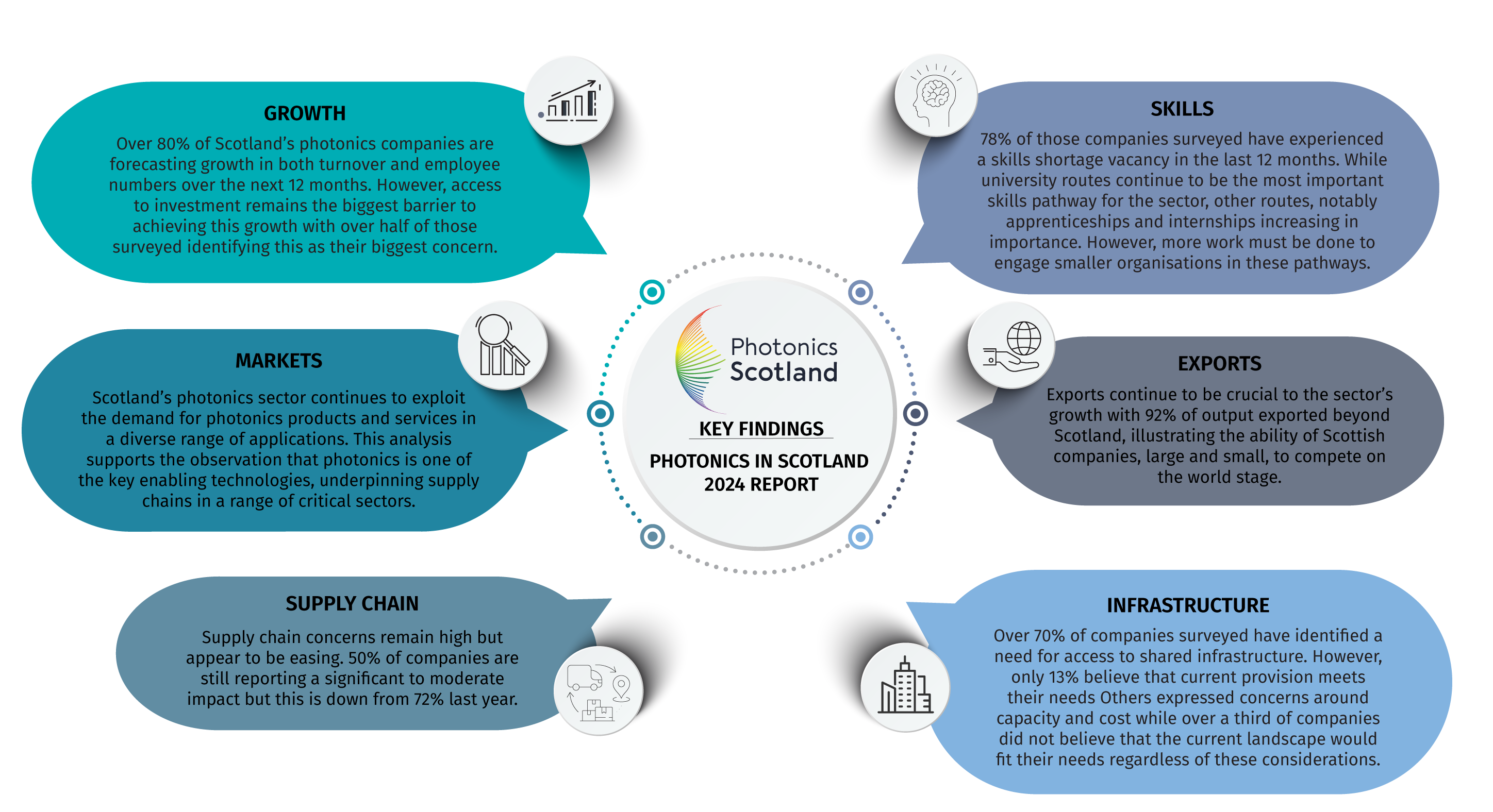

More than half of companies surveyed reported revenue growth over the last 12 months with a further 35% showing steady turnover. Perhaps even more encouragingly, over 80% of companies surveyed are forecasting increased revenues and head count over the next 12 months. Indeed, over two thirds of companies are forecasting double digit revenue growth for this period.

However, key challenges remain and for the second year in a row, access to investment has been identified as the key barrier to growth, this time by over half of companies surveyed. This is perhaps unsurprising in a sector that requires frequent and expensive capital investment cycles to maintain state of the art, expand capacity and remain competitive in a global market. Government and its agencies must work with industry and the private investment community to develop investment pathways that will allow our companies to compete on an increasingly competitive global stage.

The skills landscape also remains challenging with 78% of respondents experiencing a skills gap in the last 12 months. While 65% of companies identified gaps within research and development functions, it is interesting to note that significant gaps have also been identified in manufacturing and operations (43%) and commercial functions (17%). Addressing the skills challenge will require interventions across the skills landscape. Interestingly companies identified the importance of multiple skills development pathways with university routes seen as most critical, but also significant demand in alternative routes such as apprenticeships, internships and CPD training.

This year’s survey has also highlighted the importance of access to shared infrastructure, particularly for high growth and scaling companies, providing such companies with facilities needed to undertake product development, produce proof of concept products and demonstrate ability to scale. This observation will need further analysis in the context of the ongoing Scottish Government Deep Tech cluster review, an activity that will focus on infrastructure challenges related to scaling innovation.

As in previous years, our companies report involvement in a range of market areas, illustrating the importance of photonics technologies across a range of critical supply chains. This diversity also underpins much of the stability we have seen in the sector over the last 5 years as companies exploit multiple different opportunities. The survey also provided important evidence of the deep roots of the sector in Scotland with over 90% of companies reporting more than one operational function within their Scottish footprint i.e., manufacturing, research, sales and marketing, consultancy. This important parameter provides an important measurement of the ‘stickiness’ of the sector, an important consideration in the context of domestic and foreign investment.